October 28, 2020

Chilean salmon bears brunt of COVID-19 market adjustments

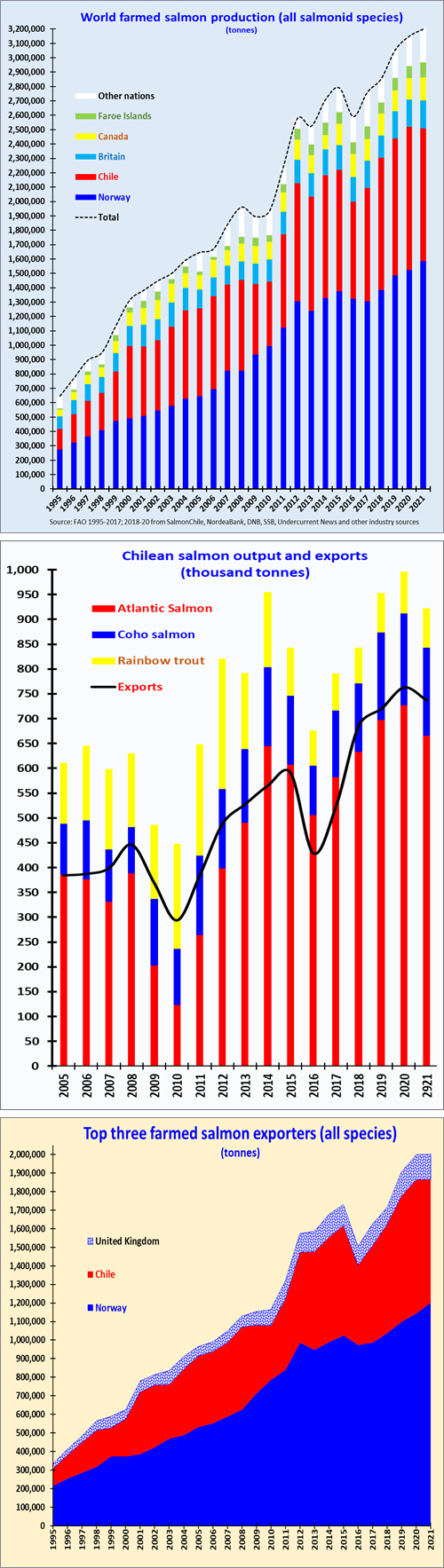

Norway's slow salmon output growth, dependence on stable EU consumption kept it profitable. Rapidly growing Chilean output was export-dependent on nations deeply affected by COVID-19.

By Eric J. Brooks

An eFeedLink Hot Topic

With early 2020 salmon output growing twice as fast as Norway's and its exports falling off faster, Chilean producers suffered more during Q2's COVID-19 lockdowns.

With early 2020 salmon output growing twice as fast as Norway's and its exports falling off faster, Chilean producers suffered more during Q2's COVID-19 lockdowns.In particular, exports to recession racked Russia and neighboring Brazil both plunged by 18% on-year in Q2. Brazil was a particularly rough blow, as this neighboring nation usually buys over half of Chile's salmon exports.

Late Q1 and early Q2 also saw a steep drop in exports to China, which was in COVID-19 lockdown at the time.

On one hand, Chile got lucky: Fortunately, China and East Asia suffered minimal COVID-19 economic damage, leaving their appetite for salmon imports unscathed. After China emerged from lockdown in early Q2, its appetite for salmon recovered quickly.

H1 2020 exports to China totaled 10% above last year's volume, to 11,000 tonnes – but this was far below the doubling of H1 shipments to 20,000 tonnes (and 2020 shipments exceeding 50,000 tonnes) that had been hoped for.

Chile successfully redirected exports destined for Brazil or Russia to Japan, where H1 2020 exports jumped 36%, to 68,000 tonnes. Small but fast-rising export quantities of exported salmon were also redirected to South Korea and Vietnam.

Leveraging this intersection of luck, quick thinking, and a late Q2 revival of Chinese salmon consumption, Chile exported a record 63,000 tonnes in July. H1 2020 exports were up 5.8% by volume on-year – but not by value.

The lowest export growth in years was overwhelmed by a 9% rise in H1 salmon output. Bloated inventories put downward pressure on prices: From January to August 2019, Chilean salmon exports earned roughly US$8.30/kg. This year they averaged $6.80/kg, with the price falling to near US$6.00/kg after shipments surged in mid-year. H1 export earnings per kg are down roughly 25% from a year ago.

Lower revenues, the cost of unsold inventories, and COVID-19 inflated transport expenses made Chilean salmon farms suffer serious losses in H1. Chilean producers responded by drastically cutting back smolt releases. From 9% H1 output growth, steeply falling pond re-stocking will limit 2020's production increase to around 4.4%, totaling 995,000 tonnes. It will make 2021 Chilean salmon output to fall approximately 7.5%, to just over 920,000 tonnes.

With Norway's H1 salmon output up only 4.6%, Norwegian farms were less impacted by COVID-19. While forced to slash prices, lower inventories of unsold salmon prevented them from suffering net losses. Moreover, European consumers quickly shifted a large portion of their salmon consumption from restaurants to cooking at home. This lessened the impact of European lockdowns on Norwegian exporters.

Chile's salmon sector is more dependent on sales to the US, where lockdown salmon consumption fell more steeply and the substitution of home cooking for restaurants occurred more slowly. The one consolation being that America's restaurant sector emerged from the lockdown more quickly. Thus, even though both Norway and Chile had to cut salmon prices to clear bloated inventories, Chile had to cut prices by more due to its larger inventory overhang and slacker export demand.

Due to their larger proportion of American and Asian customers, Chilean transport costs were already higher than those of Norway, which mostly ships to nearby European nations. COVID-19's disruption of shipping further inflated Chilean shipping costs. Burdened by a larger inventory overhang, more unstable export demand, and greater transport cost inflation, Chilean producers suffered net losses while their Norwegian rivals rode out COVID-19 with thin profit margins.

Both Chile and Norway responded to this year's chaotic market downturn by cutting smolt production but Chile did far more sharply. Based on smolt placings, Norway is on track to boost 2021 salmonid production by 3.9%, from this year's 1.525 million tonnes to 1.585 while Chile is poised to have a 7% to 8.5% fall in salmonid production, from 2020's 996,000 tonnes back down to 920,000 tonnes.

Assuming the world economy recovers from this year's lockdown induced deflation, consumption growth will exceed 2021's projected 1.6% increase in farmed salmonid production (to 3.2 million tonnes). That implies that after a year of devastating 40% deflation, salmon prices should rebound by at least a third, averaging NOK60/kg (US$6.42/kg) in 2021. That should make it a profitable year for producers in Chile, Norway, and also tier 2 exporting nations.

All rights reserved. No part of the report may be reproduced without permission from eFeedLink.