October 21, 2020

Salmon falls hard, with price rallies, output deceleration and volatility ahead

Production outraced exports, deflating prices. Output cutbacks, rising demand point to late-year price rally, and a highly volatile 2021.

By Eric J. Brooks

An eFeedLink Hot Topic

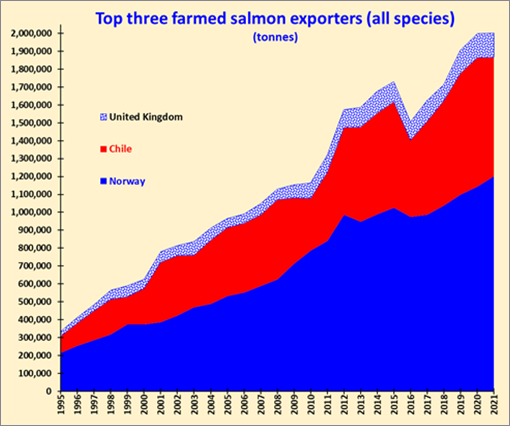

After years of chronic supply deficits, salmon price hyperinflation stimulated strong supply growth –and it collided with a steep demand downturn: Powered by a 9% increase in Chilean production, Kontali estimates that in H1 a 7% on-year jump in world salmon production 7% on-year increase crashed headfirst into a sharp, lockdown induced drop in Q2 salmon consumption.

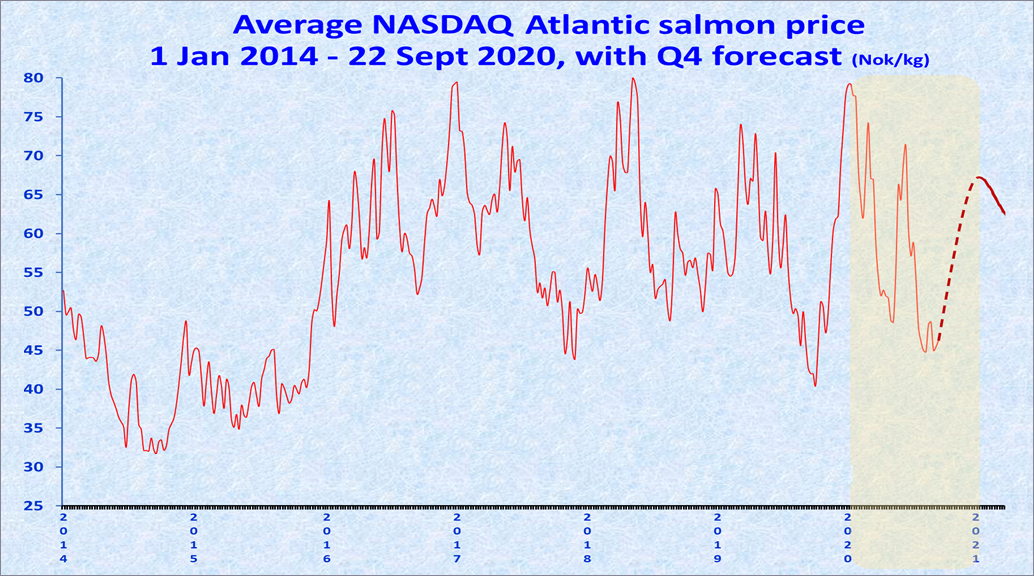

Consequently, after peaking above NOK79/kg (US$8.91/kg) at the start of 2020, it fell 43%. Salmon bottomed out at NOK45.45/kg (US$5.00./kg) and was still 42% below its pre-pandemic peak at the time of publication.

Alongside a cyclical tendency for prices to peak in late Q4/early Q1, salmon prices entered 2020 at a record high for a more predictable reason. At the North Atlantic Seafood Forum (NASF) 2020 in Bergen, Norway, Kontali CEO Ragnar Nystøyl noted 2019 world salmon output expanded a healthy 7% across all species (to 3.044 million tonnes) but demand again exceeded supply growth, rising by over 7%. With supply growth again lagging demand, salmon again touched its NOK79/kg record high but did not exceed it.

Market momentum reversed itself in Q2 when supply adjustments badly lagged COVID-19 induced consumption downturns. For a frightening few months, hotel and restaurant demand plunged before home-based consumption could be substituted in its place.

Consequently, market observers expect 2020 world farmed salmon output to rise by 2% to 4% instead of the initially forecasted 7%. (We forecast a 3% increase, from 2019's 3.055 million tonnes to 3.150 million tonnes in 2020). On the other hand, H1 2020 salmon production increased nearly 7% on-year even as COVID-19 lockdowns disrupted demand, transport schedules, and shipping logistics. The resulting bloated inventories and great uncertainty induced steep price deflation of more than 40% --but the worst now seems over.

During the lockdowns, hotel and restaurant demand for salmon vanished. That was immediately known and deflated prices. What was not immediately known was the extent to which consumers in America and Europe substituted home-cooked salmon in place of restaurant meals. The Q3 issue of Globefish Highlights notes that "The move from foodservice to home consumption has generally been faster than expected in Europe, meaning suppliers have been able to redirect production to the new source of demand without significant financial damage."

During the lockdowns, hotel and restaurant demand for salmon vanished. That was immediately known and deflated prices. What was not immediately known was the extent to which consumers in America and Europe substituted home-cooked salmon in place of restaurant meals. The Q3 issue of Globefish Highlights notes that "The move from foodservice to home consumption has generally been faster than expected in Europe, meaning suppliers have been able to redirect production to the new source of demand without significant financial damage." This was especially beneficial for EU-dependent Norwegian exporters, less so for Chilean suppliers, which faced declining demand in Brazil, one of their most important export markets. Similarly, China upset markets by temporarily banning Norwegian salmon in mid-year (when the coronavirus was detected in packaging) but its post-lockdown demand for salmon recovered, with robust import volumes.

Going forward, Japanese and Korean salmon demand was virtually unaffected and China's appetite for salmon is growing strongly again. European consumers and more recently, Americans have boosted consumption of home-cooked salmon and made up many sales lost by locked down hotels and restaurants. Moreover, the Q3 easing of lockdowns has made for a partial recovery in restaurant demand – though this is tentative on mass lockdowns not resuming in Q4.

With H2 salmon output flat or declining, trade is aggressively recovering from COVID-19's demand shock and consumption is entering its yearly late Q4/early Q1 peak. Unsold Chilean inventories will soon be depleted. Prices will rise 30% and peak in the NOK60/kg to NOK66/kg (US$6.42/kg to US$7.06/kg) range by late Q4. Thereafter they will average near NOK60/kg in 2021.

This should return producers in Chile, Norway, and other nations to near-normal levels of profitability during Q4 2020 and (barring any further economic shocks) and throughout 2021. Nevertheless, an uncertain post-COVID-19 situation will limit world farmed salmonid output increases to around 1.6% (to 3.2 million tonnes) in 2021. This will be the result of a 7% to 8.5% fall in 2021 Chilean salmon production, counterbalanced by a 3.5% to 4.0% rise in Norway's output and faster slightly faster growth in tier 2 exporting nations.

This small output increase will cause price hyperinflation if economies return to normal –but cannot stop deflation if a new round of COVID-19 lockdowns occurs. Consequently, the scope for price volatility is even greater in 2021 than it was in 2020.

All rights reserved. No part of the report may be reproduced without permission from eFeedLink.