October 7, 2020

US, Australian beef constrained by drought, falling per capita consumption

By Eric J. Brooks

A eFeedLink Hot Topic

Among top beef exporters, only the beef output of India (+257%, 4.24 million tonnes in 2019), Paraguay (215%, 0.71 million tonnes), and Brazil (151%, 10.2 million tonnes) grew significantly over the past two decades.

Among top beef exporters, only the beef output of India (+257%, 4.24 million tonnes in 2019), Paraguay (215%, 0.71 million tonnes), and Brazil (151%, 10.2 million tonnes) grew significantly over the past two decades.America still leads in beef production but its 2020 output is the same as it was in 2000 (12.3 million tonnes). The output of leading exporters Canada (1.28 million tonnes) and Australia (2.43 million tonnes) increased a mere 2% over these same two decades.

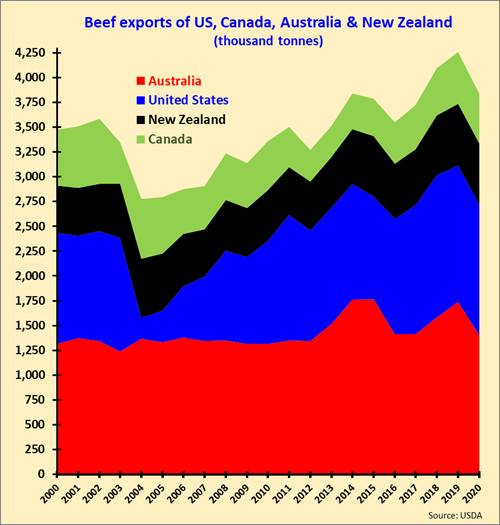

On the other hand, while Australian and American beef output barely changed, over those two decades, US (22.6%, 1.37 million tonnes) and Australian (32.1%, 1.738 million tonnes) exports increased significantly. For both America and Australia, the story was one of drought-constrained production with beef consumption falling as fast or faster than output, resulting in an exportable surplus.

America had 17% more people in 2019 than in 2000 but beef consumption fell from 12.5 to 12.3 million tonnes. Except during when it was blocked from the world market by mad cow disease, the US typically exports 1.1 million to 1.3 million tonnes of high-value cuts while importing a near equivalent quantity of imported ground beef in both 2000 and 2020. With mid-2010 cattle prices at record highs, it would have pushed output and exports higher a multi-year drought not got in the way.

Going forward, with America's domestic beef demand caught in the COVID-19 downturn, much depends on exports. While its trade agreements with Japan and South Korea ensure some export growth, much depends on America's trade relationship with China, as it can provide far more annual export growth than its other trade partners combined.

Similarly, Australia produced approximately 2.1 million tonnes of beef in both 2000 and 2020, as rising carcass yields were offset by a relentless multidecade drought. With Australian population growth offset by falling per capita beef consumption, exports mostly stayed in the 1.3 million to 1.4 million tonne range, maxing out around 1.7 to 1.8 million tonnes when worsening severe drought or dairy market crashes forced mass cattle culling.

Going forward, Australian beef faces a paradoxical but promising future. It has strong trade agreements with Japan, South Korea and China. Two of them are holding up beef import volumes steady despite Covid-19. The other is the world's fastest growing market for red meat.

Unfortunately until Australia's stubborn twenty decade spanning drought snaps, it will not have the scope to expand production and exports that Brazil does. Until Australia's pastureland weather changes, this will give Brazil an advantage over it.

All rights reserved. No part of the report may be reproduced without permission from eFeedLink.