February 14, 2025

Swinging between gains and losses: The new norm of white-feather broiler farming in China

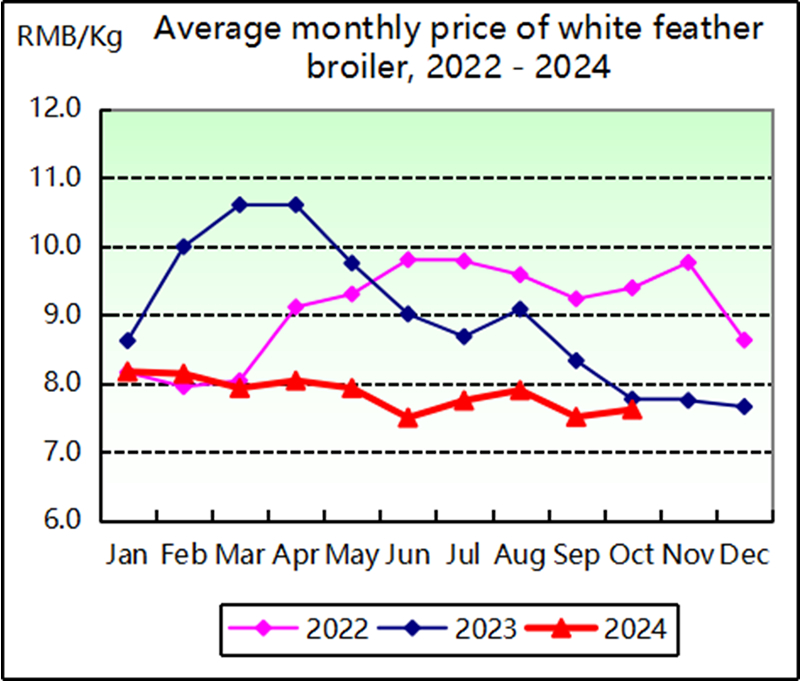

From the beginning of 2024 to the end of October, the price of white-feather broilers in China stayed between ¥8.00-7.50/kg (US$1.11-1.04/kg), with an average price of ¥7.85/kg (US$1.09/kg), down 12.66% from the average price of ¥8.99/kg (US$1.25/kg) in 2023, and down 13.37% from the average price of ¥9.06/kg (US$1.26 /kg) in 2022, the lowest in the past three years.

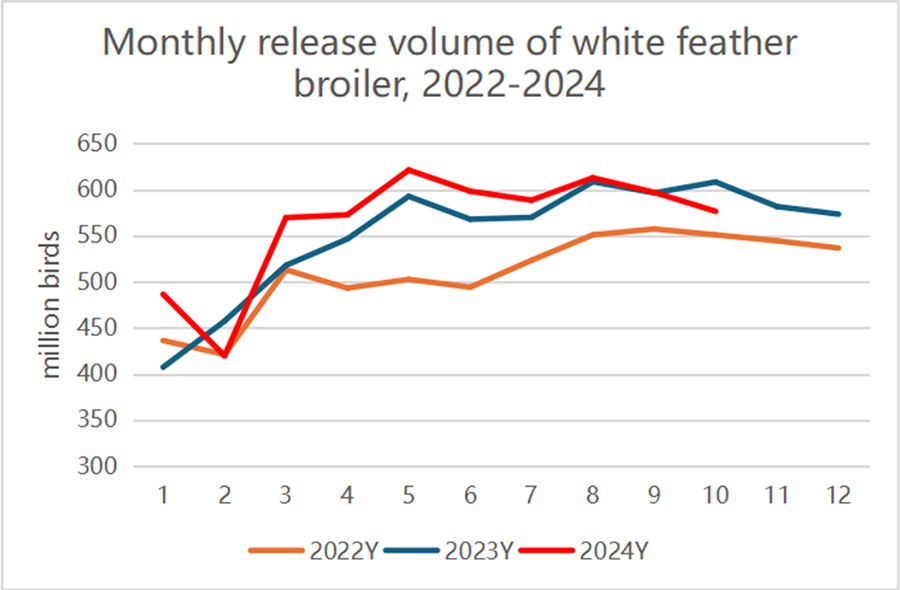

Among livestock, the price of white-feather broilers is the most sensitive to changes in supply and demand. Stimulated by the high price of white-feather broilers in 2022 and the first half of 2023 — coupled with the high number of white-feather broiler breeders in China — the annual release volume of these birds expanded relentlessly since 2022.

In 2023, the total number of broiler chickens slaughtered in China reached 13,178.40 million birds, a record high. The number of white-feather broiler chickens slaughtered also climbed to an all-time high of 66,263.93 million birds.

As supply was significantly greater than demand, the price of white-feather broiler tumbled to less than ¥8.00/kg (US$1.11/kg) in the second half of 2023, from a previous high of ¥10.50-9.00/kg (US$1.46-1.25/kg), and failed to climb above that level since then.

From January to October 2024, the number of white-feather broilers slaughtered in China expanded to 5,642.26 million, an increase of 3.11% between January and October 2023. Meanwhile, the production of yellow-feathered and hybrid broilers also increased during this period, hence resulting in excessive supply and keeping the price of white-feather broiler chickens weak at around ¥8.00/kg (about US$1.11/kg).

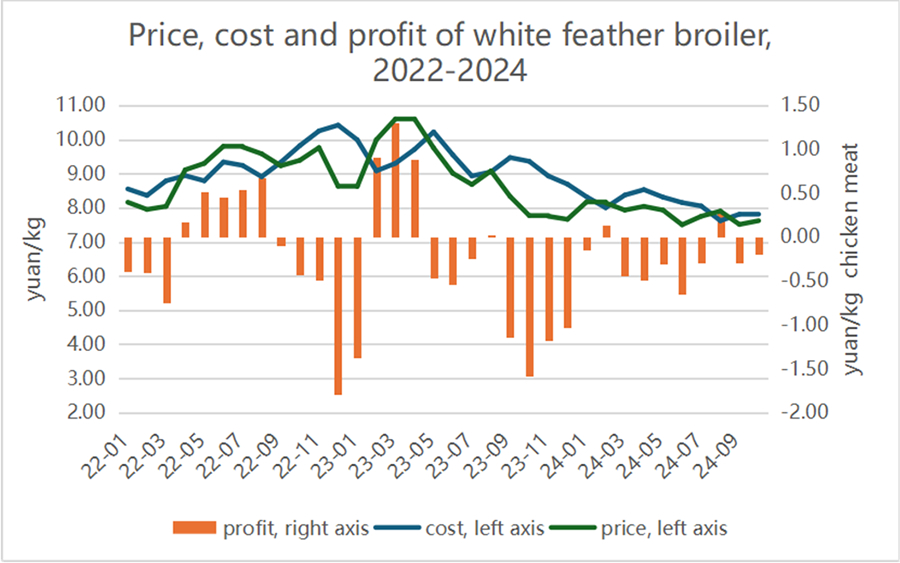

On the other hand, the continuous decline in corn and soybean meal prices have helped to lower the feed cost of white-feather broiler between January and October 2024, averaging ¥5.45 /kg broiler (approximately US$0.76/kg) — considerably below that of ¥/6.63/kg broiler chickens (US$0.92/kg) in 2023 — and ¥6.90/kg broiler ($0.96 US$/kg) in 2022. Therefore, although the price of white-feather broiler in 2024 is at a three-year low, the average return of white-feather broiler farming from January to October 2024 was not its worst. Farmers incurred a loss of ¥0.24/kg broiler chicken (about US$0.03/kg) — which was within the range of farming returns of ¥0.17-0.37/kg broiler (US$0.02-0.05/kg) in 2022-2023 — as the industry was not performing well over the past three years amid the over-expansion of breeder population.

Given that China's white-feather broiler inventory was in excess and the industry players suffered deficits, why was the population of white-feather broilers in China still growing?

Firstly, the consumption structure of broiler chickens in China has changed. As live chicken sales are banned in China, hence severely crippling the sales of native yellow-feathered broilers, white-feather broiler producers jumped on the opportunity to fill the void and ventured to expand their production scales. Secondly, China's white-feather broiler breeding is already highly integrated, mainly dominated by integrators or groups whose white-feather broiler farming is only one of their business units. These large broiler producers make plans on a macro basis and the slight loss of broiler farming in the near term is not their main concern.

Additionally, the supply of white-feather broilers is closely related to the quantity of broiler breeders. Since 2021, China has approved three new species of broiler breeders developed by local companies. This has brought down the cost of grandparent stock breeder broilers, reduced China’s reliance on imported species from the United States and Europe, and encouraged breeder farms to expand inventories.

From January to September 2024, 1.092 million sets of grandparent stock white-feather breeders were added to the inventory, a year-on-year increase of 12.48%. Among these, China-produced species accounted for 32.42%. In 2023, this proportion was at 42%.

It is reasonable to forecast that there will be no shortage of white-feather broiler breeders in China as producers compete to maximise their market shares. This will in turn translate to an abundant supply of commercial white-feather broilers, but exerting pressure on the prices. As such, high profit margins seen in the past are unlikely to reappear, and modest profits and small losses will become the norm.

About EFL AG-DATA

EFL AG-DATA is a startup incubated by Singapore's Nanyang Technological University's Innovation and Enterprise Company (NTUitive) Incubator Program. It is developing an agricultural hub that will revolutionize the feed-to-meat supply chain in China and Southeast Asia countries through data-driven solutions. EFL's mission is to empower farms through innovative data-based services that solve complex problems and enhance productivity.

- EFL AG DATA